In May, just over 51 million retired workers took home an average Social Security benefit of $1,916.63, which amounts to about $23,000 on an annualized basis. While Social Security payments won’t make anyone rich, they have historically played a key role in laying a financial foundation for America’s aging workforce.

According to an analysis by the Center on Budget and Policy Priorities, this flagship program lifted 22.7 million people above the federal poverty line in 2022 — 16.5 million of whom were adults age 65 and older. Meanwhile, 23 consecutive years of polling by national pollster Gallup have found that between 80% and 90% of retirees rely on their monthly Social Security income to cover at least some of their expenses.

Social Security income is vital to the financial well-being of retired workers, so beneficiaries wait on pins and needles for the annual disclosure of the program’s cost of living adjustment (COLA). While the 2025 Social Security COLA is on track to do something not seen in 28 years, it is also poised to disappoint the retiree beneficiaries who rely most heavily on the program.

Image source: Getty Images.

How is the Social Security cost of living adjustment (COLA) calculated?

Social Security’s COLA is the mechanism that accounts for changes in the price of goods and services. As a generalized example, if the price of a broad basket of goods and services that seniors regularly purchase increases, Social Security checks should (in an ideal world) increase by the same percentage to ensure that there is no loss of purchasing power. . COLA is the tool that factors in inflation (price increases) or deflation (price decreases) that program beneficiaries are struggling with.

There has been a night-and-day change in COLA calculation since the first Social Security retiree benefit was mailed in January 1940. For the first 35 years of the program’s history, COLAs were completely arbitrary and were approved by special sessions of Congress. After no COLAs were issued during the 1940s, 11 adjustments were enacted between 1950 and 1974.

Beginning in 1975, the Consumer Price Index for Urban Wage and Clerical Workers (CPI-W) became the inflationary tool used to calculate the annual Social Security COLA. Each expenditure category within the CPI-W has a specific weight, which allows this inflation index to be condensed into a single figure at the end of each month. This makes easy comparisons with the previous month or year to determine if inflation or deflation has occurred.

The interesting feature when calculating Social Security’s cost of living adjustment is that only trailing 12-month CPI-W readings from the third quarter (July-September) are used in the calculation.

If the average reading of the CPI-W for the third quarter (Q3) of the current year is higher than the average reading of the CPI in the comparable period of the previous year, inflation has occurred and beneficiaries must pay more. The size of the COLA is determined by the year-over-year percentage increase in third quarter CPI-W readings, rounded to the nearest tenth of a percent.

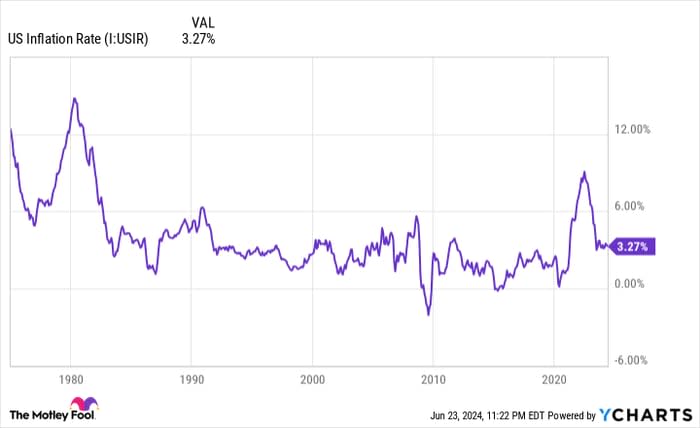

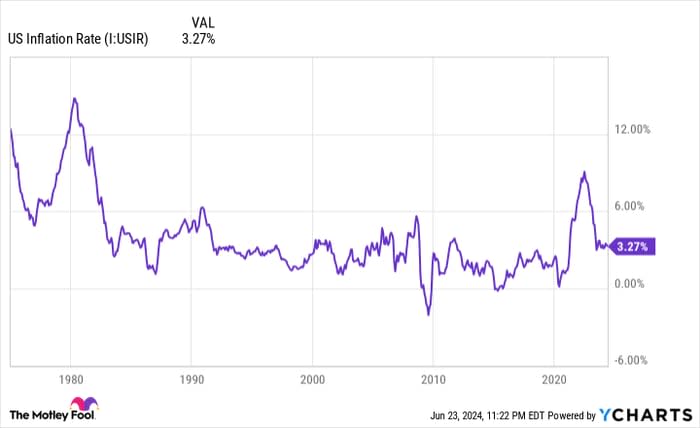

An elevated inflation rate has resulted in three consecutive years of above-average COLAs. US inflation rate data according to YCharts.

Social Security’s COLA is on the verge of making history

After three years of above-average cost-of-living adjustments, Social Security recipients have high hopes that the trend will continue. In 2022, 2023, and 2024, the program’s respective COLAs were 5.9%, 8.7%, and 3.2%, which topped the COLA average over the past two decades of 2.6%.

Although we haven’t even gotten to the last few months that matter in the COLA calculation, the reported monthly CPI-W provides some clues as to what to expect. Based on the May inflation report from the US Bureau of Labor Statistics, the nonpartisan senior advocacy group The Senior Citizens League (TSCL) projects a COLA of 2.57% (to be rounded to 2.6%) in 2025. Although that’s just short of TSCL’s 2.66% forecast after the April inflation report would mark yet another year of average or above-average COLAs for program beneficiaries.

Independent Social Security and Medicare policy analyst Mary Johnson, who was previously with TSCL before her retirement, estimates that the 2025 Social Security COLA will come in at 3%. While that’s modestly below its 3.2% COLA forecast for 2025 after the April inflation report, it still suggests another strong increase is on the way.

If Social Security’s 2025 COLA comes in at or above TSCL’s forecast, it will mark the fourth consecutive year of COLAs reaching at least 2.6% since 1997. Considering that 10 of the previous 15 COLAs have ranged between 0% and 2%, a minimum A COLA of 2.6% is, on paper, a welcome sight.

For those of you wondering, a 2.6% COLA would translate to roughly a $50 per month increase in the average retired worker’s check. Meanwhile, Johnson’s projected 3% COLA would lead to a benefit increase of about $57 per month in 2025 for retiree beneficiaries.

Image source: Getty Images.

Retired workers are up in arms, once again

With Social Security’s cost-of-living adjustment on track for its fourth consecutive significant increase, you might think retirees are all smiles. Unfortunately, this couldn’t be further from the truth.

According to a TSCL analysis, COLAs implemented by Social Security have fallen below the actual rate of inflation in four of the past five years. Based on the May inflation report, 2025 looks like it will mark the fifth time in six years that the Social Security COLA will lag behind the prevailing rate of inflation. For TSCL, the purchasing power of a Social Security dollar fell 36% between January 2000 and February 2023.

How is it possible that an inflation index (CPI-W) can do such a poor job of accounting for the price pressures that Social Security recipients are facing? The answer lies in its construction.

As its full name clearly states, the CPI-W focuses on the spending habits of “urban wage earners and white-collar workers.” These are typically working-age individuals who are not currently receiving a Social Security check. More importantly, working-age Americans spend their money differently than the elderly who make up 86% of Social Security beneficiaries.

The clear culprit for this dynamic now is housing costs (rent or owner-occupier equivalent rent). Seniors spend a higher percentage of their monthly budget on housing than the average working American. That’s a problem when the unadjusted 12-month housing inflation rate, based on the Consumer Price Index for All Urban Consumers (CPI-U), is a scorching 5.4%! Shelter is also the largest weighted component in the CPI-U and CPI-W.

The bottom line for the Federal Reserve and seniors is that there is no quick fix for stubbornly high housing inflation. The country’s central bank aimed to tackle historically high inflation head-on with an aggressive rate hike cycle, and in doing so has effectively frozen the market for existing home sales. With most homeowners enjoying historically low mortgage rates, the desire to give up their current home for a mortgage rate of 7% or higher is pretty low.

Until housing costs move semantically lower, or Congress moves from CPI-W to a different inflation measure, this dynamic where Social Security COLAs are insufficient to cover the current rate of inflation that seniors are struggling with is likely to continue .

$22,924 Most retirees completely overlook the Social Security bonus

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” can help ensure a boost to your retirement income. For example: a simple scam can pay you up to $22,924 more… every year! Once you learn how to maximize your Social Security benefits, we think you can confidently retire with the peace of mind we all seek. Just click here to find out how to learn more about these strategies.

Watch “Secrets of Social Security” ›

The Motley Fool has a disclosure policy.

#Social #Security #Cost #Living #Adjustment #COLA #set #disappointed #time #years #reason #clear #day

Image Source : www.aol.com